Finding the best ASIC miners for Bitcoin 2025 has become more critical than ever as mining difficulty continues to rise and profit margins tighten. With Bitcoin’s growing value and the increasing complexity of mining algorithms, choosing the right Application-Specific Integrated Circuit (ASIC) miner can mean the difference between profitable operations and costly losses. The Bitcoin mining landscape has evolved dramatically, and today’s miners need equipment that balances hash rate performance, energy efficiency, and return on investment.

Whether you’re a seasoned mining farm operator or a newcomer looking to enter the cryptocurrency mining space, understanding which ASIC miners deliver the best performance in 2025 is essential. This comprehensive guide examines the top-performing mining rigs available today, analyzes their profitability metrics, and helps you make an informed decision based on your budget, electricity costs, and mining goals. Let’s dive into the world of Bitcoin mining hardware and discover which machines are leading the pack this year.

What Are ASIC Miners and Why Do They Matter?

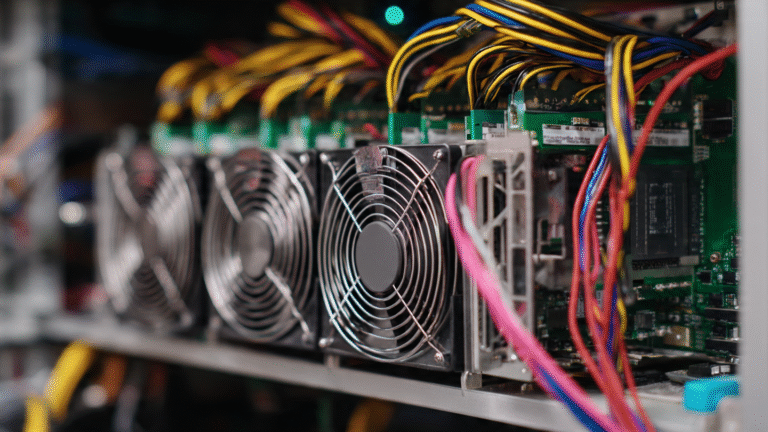

ASIC miners are specialized hardware devices designed exclusively for cryptocurrency mining. Unlike general-purpose computers or graphics cards, these machines are built from the ground up to solve the complex mathematical problems required to validate Bitcoin transactions and secure the blockchain network.

The Evolution of Bitcoin Mining Hardware

Bitcoin mining has progressed through several technological generations. In the early days, miners used regular CPUs, then upgraded to GPUs, and eventually moved to FPGA devices. However, ASIC miners revolutionized the industry by offering unprecedented efficiency and hash rate capabilities that other hardware simply cannot match.

The key advantage of ASIC technology lies in its singular focus. These devices perform one task extraordinarily well: mining Bitcoin using the SHA-256 algorithm. This specialization translates to superior performance per watt compared to any other mining method.

Understanding Hash Rate and Efficiency

When evaluating ASIC miners, two metrics stand out: hash rate and power efficiency. Hash rate, measured in terahashes per second (TH/s), indicates how many calculations the miner can perform. Power efficiency, measured in joules per terahash (J/TH), shows how much electricity the device consumes to achieve that hash rate.

Modern ASIC miners in 2025 have pushed boundaries significantly, with top models achieving over 150 TH/s while maintaining competitive power consumption levels. The balance between these factors directly impacts your mining profitability.

Best ASIC Miners for Bitcoin 2025: Top Picks Reviewed

1. Antminer S21 XP Hyd (Bitmain)

The Antminer S21 XP Hyd represents Bitmain’s flagship hydro-cooled mining solution for 2025. This powerhouse delivers an impressive hash rate while maintaining excellent energy efficiency through its innovative liquid cooling system.

Key Specifications:

- Hash Rate: 473 TH/s

- Power Consumption: 11,000W

- Efficiency: 23.3 J/TH

- Cooling: Hydro-cooling system

- Price Range: $18,000 – $22,000

The hydro-cooling technology allows this miner to operate in demanding environments while maintaining stable performance. Mining operations with access to cheap electricity and proper cooling infrastructure will find this model particularly attractive. The S21 XP Hyd excels in industrial-scale operations where maximizing output per unit is crucial.

Profitability Analysis: With current Bitcoin prices and average electricity costs, the S21 XP Hyd can generate substantial daily returns. However, the initial investment is significant, and ROI periods typically range from 12 to 18 months depending on your electricity rates and Bitcoin’s market value.

2. Whatsminer M60S (MicroBT)

MicroBT’s Whatsminer M60S has emerged as a serious competitor to Bitmain’s dominance. This air-cooled unit combines impressive performance with relatively lower upfront costs, making it attractive for mid-sized mining operations.

Key Specifications:

- Hash Rate: 186 TH/s

- Power Consumption: 5,400W

- Efficiency: 29 J/TH

- Cooling: Advanced air cooling

- Price Range: $5,500 – $7,000

The M60S strikes an excellent balance between performance and affordability. Its air-cooling design simplifies installation and maintenance compared to hydro-cooled alternatives. For miners operating in moderate climates with adequate ventilation, this model offers exceptional value.

Performance in Real-World Conditions: Independent testing shows the M60S maintains stable hash rates across various operating temperatures. The unit’s robust build quality and reliable firmware updates make it a dependable choice for long-term mining operations.

3. Antminer S21 (Bitmain)

Bitmain’s standard S21 model provides excellent performance for miners seeking a proven, reliable option without the complexity of liquid cooling systems. This air-cooled unit has become one of the most popular choices among serious Bitcoin miners in 2025.

Key Specifications:

- Hash Rate: 200 TH/s

- Power Consumption: 3,500W

- Efficiency: 17.5 J/TH

- Cooling: Air cooling

- Price Range: $4,800 – $6,200

The S21’s exceptional power efficiency makes it particularly attractive for operations in regions with higher electricity costs. Its lower power draw compared to hydro-cooled models means reduced infrastructure requirements and simpler deployment.

Why Miners Choose the S21: The combination of solid performance, proven reliability, and competitive pricing has made the S21 a bestseller. Its efficiency rating positions it among the most profitable miners per watt consumed, which directly impacts your bottom line.

4. Avalon Made A1466 (Canaan)

Canaan’s Avalon Made A1466 represents an intriguing option for miners seeking alternatives to the dominant Bitmain-MicroBT duopoly. This miner brings competitive specifications with some unique features.

Key Specifications:

- Hash Rate: 150 TH/s

- Power Consumption: 3,400W

- Efficiency: 22.7 J/TH

- Cooling: Enhanced air cooling

- Price Range: $3,800 – $4,800

Canaan has focused on improving their miner’s acoustic performance, making the A1466 quieter than many competitors. For home miners or smaller operations where noise levels matter, this consideration shouldn’t be overlooked.

5. Whatsminer M63S (MicroBT)

The M63S represents MicroBT’s answer to the ultra-high-performance segment, competing directly with Bitmain’s premium offerings while typically carrying a lower price tag.

Key Specifications:

- Hash Rate: 390 TH/s

- Power Consumption: 8,100W

- Efficiency: 20.8 J/TH

- Cooling: Hybrid air cooling

- Price Range: $12,000 – $15,000

This model targets professional mining operations that need maximum hash rate without committing to hydro-cooling infrastructure. The M63S delivers exceptional performance density, allowing operations to maximize output per square foot of facility space.

Factors to Consider When Choosing ASIC Miners

Electricity Costs and Power Efficiency

Your local electricity rate is perhaps the single most important factor in determining mining profitability. Even the most powerful ASIC miner becomes unprofitable if your electricity costs are too high. Calculate your kilowatt-hour (kWh) rate and use mining profitability calculators to estimate potential returns.

Power efficiency becomes increasingly critical as mining difficulty rises. A miner with superior J/TH ratings will maintain profitability longer as network conditions change. The difference between 17 J/TH and 30 J/TH might seem small, but it compounds significantly over months of continuous operation.

Initial Investment vs. ROI Timeline

Mining hardware represents substantial capital expenditure. The best ASIC miners for Bitcoin 2025 range from several thousand to tens of thousands of dollars per unit. Understanding your ROI timeline helps align your investment with your financial goals.

Consider these factors when calculating ROI:

- Purchase price and shipping costs

- Installation and infrastructure expenses

- Monthly electricity costs

- Expected Bitcoin price movements

- Network difficulty projections

- Maintenance and replacement considerations

Most profitable operations achieve ROI within 12-24 months under normal market conditions. However, Bitcoin’s volatility means actual timelines can vary significantly.

Cooling Requirements and Operating Environment

Different ASIC miners have varying cooling requirements. Hydro-cooled models offer superior performance but require specialized infrastructure including water pumps, radiators, and cooling towers. Air-cooled units are simpler to deploy but need adequate ventilation and climate control.

Consider your facility’s capabilities:

- Ambient temperature ranges

- Ventilation capacity

- Humidity levels

- Available cooling infrastructure

- Noise tolerance

- Maintenance accessibility

Industrial mining farms often prefer hydro-cooled units for their higher density and better heat management. Home miners or smaller operations typically opt for air-cooled models due to simpler requirements.

Manufacturer Reputation and Support

Choose manufacturers with proven track records. Bitmain, MicroBT, and Canaan lead the industry with established support networks, regular firmware updates, and reliable warranty services. Lesser-known manufacturers might offer attractive prices but can pose risks regarding longevity, support, and resale value.

Research warranty terms carefully. Most reputable manufacturers offer 180-day to 1-year warranties covering manufacturing defects. Extended warranty options are sometimes available for additional cost.

Bitcoin Mining Profitability in 2025

Current Network Conditions

Bitcoin’s mining difficulty adjusts approximately every two weeks to maintain a consistent block generation rate. As more miners join the network, difficulty increases, requiring more computational power to maintain the same earning potential. Understanding these dynamics is crucial for long-term planning.

In 2025, Bitcoin mining has become increasingly competitive. The hash rate securing the network has reached unprecedented levels, meaning individual miners must deploy more efficient hardware to remain profitable. This trend emphasizes the importance of choosing miners with superior efficiency ratings.

Calculating Your Potential Earnings

Several factors determine your mining earnings:

Block Rewards and Transaction Fees: Bitcoin’s block reward currently stands at 3.125 BTC per block after the 2024 halving. Miners also collect transaction fees, which can vary significantly based on network congestion.

Pool Mining vs. Solo Mining: Most miners join mining pools to receive more consistent payouts. Pools distribute rewards proportionally based on contributed hash power, minus a pool fee typically ranging from 1% to 3%.

Daily Revenue Estimates: Use online calculators to estimate earnings based on your hash rate, power consumption, and electricity costs. Remember that Bitcoin’s price volatility significantly impacts profitability calculations.

Optimizing Mining Operations

Maximize profitability through strategic management:

Firmware Optimization: Manufacturers regularly release firmware updates improving efficiency and stability. Keep your miners updated to benefit from performance enhancements.

Overclocking and Underclocking: Advanced miners can adjust their hardware settings to optimize the hash rate-to-power ratio. Underclocking can extend hardware lifespan and reduce electricity costs during periods of lower Bitcoin prices.

Temperature Management: Maintaining optimal operating temperatures extends hardware longevity and maintains peak performance. Invest in adequate cooling infrastructure appropriate for your chosen miners.

Where to Buy ASIC Miners Safely

Authorized Distributors and Manufacturers

Purchase directly from manufacturers when possible:

- Bitmain: Official website and authorized distributors

- MicroBT: Regional distributors and official channels

- Canaan: Direct sales and certified resellers

Buying from authorized sources ensures genuine products, valid warranties, and manufacturer support. Be extremely cautious of deals that seem too good to be true, as counterfeit miners and scams are unfortunately common in this industry.

Secondary Market Considerations

Used ASIC miners can offer value for budget-conscious miners. However, exercise caution when purchasing second-hand equipment:

- Verify the miner’s operating history

- Check remaining warranty coverage

- Test functionality before completing purchase

- Consider the unit’s expected remaining lifespan

- Factor in potential repair costs

Used miners typically sell for 40-70% of their original price depending on age, condition, and current market demand. Older generation miners might still be profitable in regions with extremely cheap electricity.

International Shipping and Import Considerations

ASIC miners are heavy, bulky items often subject to significant shipping costs and import duties. Factor these expenses into your total cost calculations:

- Shipping costs can add $100-$500 per unit

- Import duties vary by country

- Customs processing may cause delays

- Insurance for high-value shipments

- Local voltage and plug compatibility

Some distributors offer local warehousing options, potentially reducing shipping costs and delivery times.

Setting Up Your Bitcoin Mining Operation

Infrastructure Requirements

Successful mining operations require proper infrastructure:

Electrical Capacity: Ensure your electrical system can handle the load. High-performance ASIC miners draw significant power. Consult with electricians to verify your facility’s capacity and install appropriate circuits and breakers.

Internet Connectivity: Reliable internet connection is essential, though bandwidth requirements are minimal. Even a basic broadband connection suffices for multiple miners, but stability matters more than speed.

Physical Space: Account for heat generation and maintenance accessibility. Plan adequate spacing between units for airflow and servicing. Industrial operations should consider facility layout optimization to maximize efficiency.

Monitoring and Management Tools

Implement monitoring systems to track performance:

- Hash rate monitoring

- Temperature tracking

- Power consumption measurement

- Pool statistics

- Automated alerts for issues

Many miners use dedicated mining management software that provides centralized control over multiple units. These tools help identify problems quickly and optimize performance across your entire operation.

Security Considerations

Protect your mining investment:

Physical Security: Mining hardware represents significant value and attracts theft. Implement appropriate security measures including:

- Secure facility access

- Video surveillance

- Alarm systems

- Insurance coverage

Network Security: Protect your miners from digital threats:

- Secure WiFi networks

- Regular firmware updates

- Strong administrative passwords

- Network segmentation

- Firewall protection

Environmental Considerations and Sustainable Mining

Energy Source Matters

The environmental impact of Bitcoin mining has become a significant discussion point. Forward-thinking miners increasingly prioritize renewable energy sources:

Renewable Energy Options:

- Solar power installations

- Wind energy agreements

- Hydroelectric power

- Excess grid energy utilization

- Natural gas from waste methane

Mining operations powered by renewable energy not only reduce environmental impact but also often benefit from lower electricity costs. Several regions offer incentives for industrial power consumers who utilize renewable sources.

Heat Recovery and Utilization

Progressive mining operations are finding creative ways to utilize the substantial heat generated by ASIC miners:

- Greenhouse heating for agriculture

- Residential heating systems

- Industrial process heating

- Aquaculture operations

- Lumber drying facilities

These applications transform mining’s main byproduct into a valuable resource, improving overall operation economics while reducing waste.

Future Trends in Bitcoin Mining Hardware

Technological Advancements on the Horizon

The ASIC mining industry continues rapid innovation. Future developments likely include:

Improved Chip Architecture: Manufacturers are developing next-generation chips with superior efficiency. The progression toward smaller nanometer processes continues, promising better performance per watt.

Enhanced Cooling Solutions: Immersion cooling technology is gaining traction, potentially offering superior performance compared to traditional hydro-cooling or air-cooling methods.

Modular Design Improvements: Future miners may feature more modular designs allowing easier repairs and upgrades, potentially extending hardware lifespan.

Regulatory Landscape

Government regulations around cryptocurrency mining continue evolving. Stay informed about:

- Local mining regulations and licensing requirements

- Environmental compliance standards

- Tax implications and reporting requirements

- Energy usage restrictions or incentives

- Noise ordinances and zoning laws

Understanding and complying with regulations protects your investment and ensures operational continuity.

Common Mistakes to Avoid

Underestimating Electricity Costs

Many novice miners focus exclusively on hash rate without properly accounting for electricity expenses. Power costs can quickly turn promising investments unprofitable. Always calculate comprehensive operating expenses before purchasing equipment.

Neglecting Cooling Requirements

Inadequate cooling causes:

- Reduced hash rate performance

- Increased hardware failure rates

- Shortened equipment lifespan

- Throttling and downtime

- Fire hazards

Invest appropriately in cooling infrastructure from the start. Retrofitting cooling systems later is expensive and disruptive.

Ignoring Mining Pool Selection

Not all mining pools are equal. Consider:

- Fee structures (PPS, PPLNS, etc.)

- Payout thresholds

- Pool hash rate and consistency

- Geographic server locations

- Reputation and reliability

- Payment processing speed

Pool selection impacts your effective earnings. Research options thoroughly and monitor your chosen pool’s performance regularly.

Failing to Plan for Difficulty Increases

Bitcoin mining difficulty generally trends upward over time. Miners that are profitable today may become marginal or unprofitable as difficulty increases. Factor difficulty projections into your long-term planning and maintain flexibility to upgrade or scale operations.

Conclusion

Selecting the best ASIC miners for Bitcoin 2025 requires careful consideration of multiple factors, including hash rate, power efficiency, initial investment, electricity costs, and your specific operational goals. The miners highlighted in this guide represent the industry’s top performers, each offering distinct advantages for different use cases.

For large-scale industrial operations with proper infrastructure, the Antminer S21 XP Hyd and Whatsminer M63S deliver maximum hash rate and density. Mid-sized operations benefit from the balanced performance of the Antminer S21 and Whatsminer M60S, which offer excellent efficiency without extreme infrastructure requirements. Budget-conscious miners should consider the Avalon Made A1466 or carefully vetted used equipment from previous generations.

See More : Best Bitcoin Mining Hardware 2025 Top 10 ASIC Miners Reviewed