The latest BNB Chain news paints a very different picture from the fear-dominated market of just a few weeks ago. After a sharp drawdown across altcoins, the BNB Chain ecosystem has staged an impressive rebound, adding roughly $8.3 billion in market capitalization in a single week as the sector climbed about 4.1%. At the same time, BNB price has pushed back toward the 900 dollar region, small-cap tokens on BNB Chain have started to rip higher, and builders continue to deliver new DeFi, RWA and prediction market infrastructure that could shape the next leg of the cycle.

This shift is happening against a broader macro backdrop where Bitcoin briefly dropped 90,000 dollars below before reclaiming that level, and major altcoin sectors bounced after weeks of grinding losses. Market sentiment has improved from “Extreme Fear” to “Fear” on the Crypto Fear and Greed Index, suggesting that traders are no longer in full panic mode but are still far from euphoric. In other words, it is a textbook environment for a cautious risk-on rotation.

For anyone following BNB Chain news, the big question is what this $8.3B rebound really means. Is it the start of a new structural uptrend for BNB and its ecosystem, or just a sharp relief rally fueled by short covering and speculative small caps? To answer that, it helps to unpack the key numbers behind the move, examine what builders are shipping on-chain, and understand how this relates to sentiment, liquidity and long-term fundamentals.

$8.3B BNB Chain Rebound

The headline of this week’s BNB Chain news is simple: after three weeks of declines, the BNB Chain sector finally flipped green and added about $8.3 billion to its total sector market cap, equivalent to a roughly 4.1% week-on-week gain.

This increase is not about a single token mooning. Rather, it reflects a broad-based recovery across the BEP-20 token universe that trades on BNB Chain. Seven of the ten largest ecosystem tokens finished the week in positive territory, with names like Chainlink (LINK) and MYX Finance (MYX) posting double-digit percentage gains of around 12.4% and 26.7% respectively.

The backdrop is the broader crypto market shifting from defensive positioning in mega-caps to a more adventurous stance. As traders realize that the worst of the sell-off might be behind them, they begin to rotate from Bitcoin and stablecoins back into large caps, mid caps and eventually small caps on chains that show signs of real activity and innovation. BNB Chain, with its mix of established DeFi blue chips, aggressive builders and a large retail user base, is a natural beneficiary of this shift.

From Fear to Cautious Optimism

To understand why this rebound matters, look at sentiment. Over the last month, extreme volatility in Bitcoin price pushed many participants into full risk-off mode. The Crypto Fear and Greed Index moved into Extreme Fear, indicating that traders were dumping positions, hedging out exposure and sitting in stablecoins.

As BTC dropped below 90,000 dollars and then swiftly reclaimed that level, the index climbed back from Extreme Fear to Fear. That may not sound particularly bullish, but in practice it means forced selling is easing, liquidations are slowing, and opportunistic capital is beginning to look for asymmetric upside plays again. Historically, these “Fear but not Panic” phases are often when value quietly accumulates in fundamentally strong ecosystems.

BNB Chain fits that description. It has been through regulatory drama around Binance, competition from newer Layer-1s and Layer-2s, and multiple risk events across DeFi, yet it remains one of the top networks for active users, DeFi total value locked and stablecoin transfers. The $8.3B rebound is therefore less about hype and more about money rediscovering a chain that never really stopped building.

BNB Price Action and Sector Leadership

At the center of this story is BNB (BNB) itself. According to recent market data, BNB has pushed back toward the 900 dollar region after gaining roughly 4.8% over the week, reinforcing its status as by far the largest asset in the BNB Chain sector.

The chart shows a token that has been remarkably resilient compared with many altcoins. While plenty of names have seen drawdowns of 70% or more from local highs, BNB price has managed to grind higher on longer timeframes, supported by sustained fee burn mechanisms, continuous ecosystem usage and the perception that BNB serves as the “equity-like” asset of the wider Binance and BNB Chain ecosystem.

For investors looking at BNB Chain news as a directional signal, BNB’s strength relative to the broader market is often a key tell. When BNB is leading, it usually indicates renewed confidence in the chain’s long-term viability and its ability to attract liquidity, developers and users.

Why Small Caps Are Surging on BNB Chain

One of the most striking aspects of the recent rebound is that the biggest percentage winners came from the small-cap corner of the BNB Chain ecosystem. While large caps like LINK and MYX posted solid gains, the week’s standout movers were names such as c8ntinuum (CTM), which jumped about 77%, Bitlight (LIGHT) with more than 60% gains, Siren (SIREN) at nearly 40%, Sky (SKY) above 30% and meme-style plays like Brett (Based) that came close to 30% increases.

Some of these surges were driven by clear catalysts, such as Sky Protocol’s sizeable SKY token buyback or prolonged post-listing momentum and airdrop campaigns for LIGHT. Others rallied on more opaque drivers, classic hallmarks of a speculative risk-on environment where narrative and momentum can temporarily overshadow fundamentals.

What the Small-Cap Rally Signals

A small-cap rally on BNB Chain usually signals that traders are once again willing to embrace higher volatility in exchange for the potential of outsized returns. When markets are fearful, capital tends to crowd into BTC, stablecoins or a handful of mega-caps. As fear eases, flows trickle down into mid caps and small caps, providing liquidity to tokens that were previously neglected.

This has several implications. For active traders, these moves demonstrate that BNB Chain remains a vibrant hunting ground for new narratives in DeFi, AI tokens, meme coins and experimental protocols. For longer-term investors, the small-cap pump should be treated as both a sign of health and a reason for caution. Chasing thinly traded small caps after 70% weekly gains can be extremely risky, especially if the underlying project has not yet proven product-market fit or sustainable tokenomics.

Prudent participants use this type of BNB Chain news as a macro signal rather than a shopping list. It tells you that risk appetite is back and that the chain is attracting speculative interest, but it does not replace deep fundamental research into each project.

On-Chain Metrics: TVL, Stablecoins and Trading Volume

Market cap is only one dimension of the story. Under the hood, several key on-chain metrics on BNB Chain have turned in a more constructive direction, even if not uniformly bullish.

Recent data shows that total value locked (TVL) on the network has climbed about 1.6% to around 9.08 billion dollars, indicating that more capital is being committed to DeFi protocols on BNB Chain. At the same time, daily stablecoin transfer volume has jumped approximately 34.6% to 14.4 billion dollars, suggesting renewed activity in payments, swaps and on-chain liquidity flows.

However, this rebound is not without caveats. Spot and DeFi trading volumes have not kept pace across the board. In particular, PancakeSwap, the flagship DEX on BNB Chain, has seen trading volume drop about 40% week-on-week, highlighting that some speculative trading activity remains subdued despite the rise in market cap and stablecoin transfers.

A Modest Rise in Total Value Locked

The uptick in BNB Chain TVL may appear small, but context matters. After months of rotation into other ecosystems and a brutal washout in many DeFi tokens, simply stabilizing TVL is a sign that yield farmers, liquidity providers and lending protocol users are again comfortable locking capital in BNB-based dApps.

Higher TVL improves liquidity depth, tightening spreads on DEXs, enabling larger trades with lower slippage and making BNB Chain more attractive for both small retail traders and sophisticated market makers. For builders, it is a green light to deploy more complex structures such as structured products, leveraged yield strategies or real-world asset vaults that rely on sticky on-chain capital.

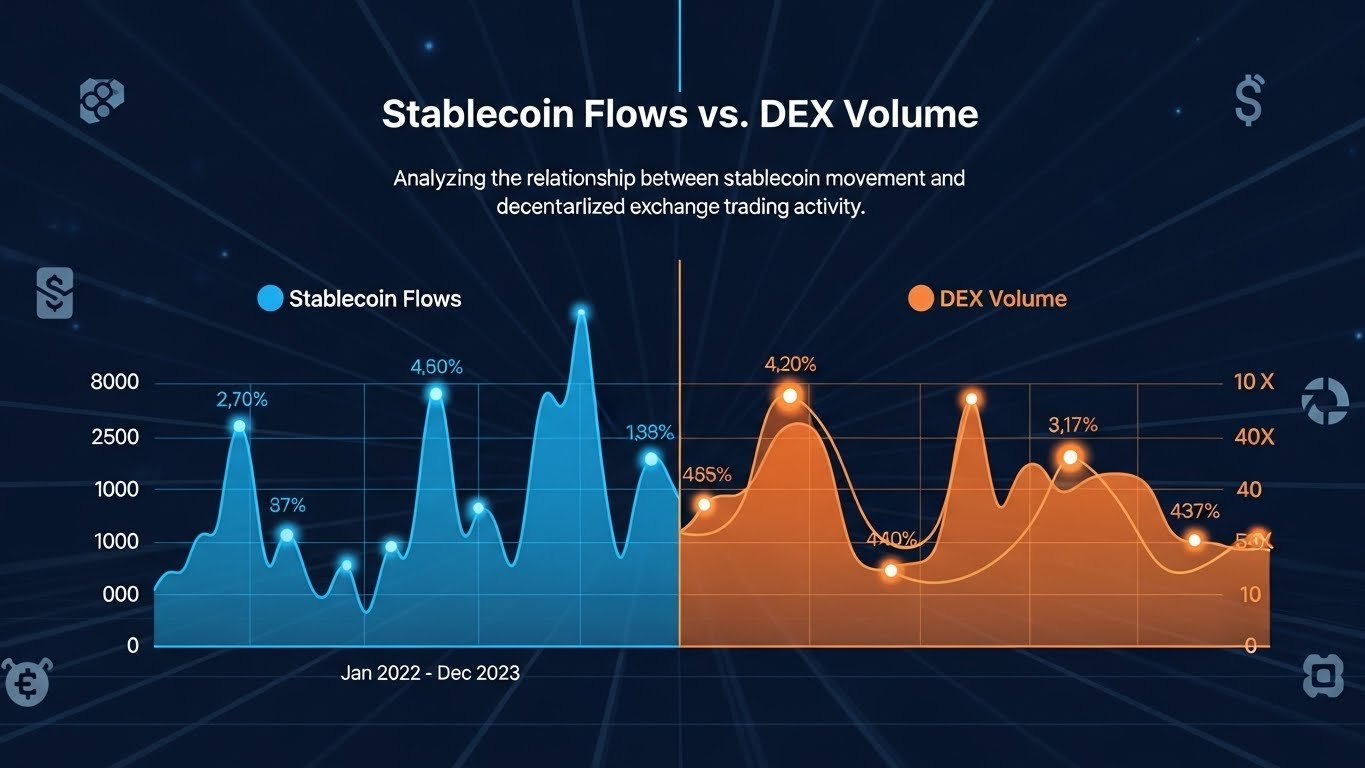

Stablecoin Flows vs. DEX Volume

The surge in stablecoin transfer volume on BNB Chain is particularly interesting. Rising stablecoin flows often precede or accompany active trading, because users move USDT, USDC or other stablecoins into position before deploying them into swaps, lending or yield strategies. Yet the sharp decline in PancakeSwap trading volume hints that a portion of those transfers may be related to treasury movements, cross-chain capital rotation or non-DEX use cases rather than classic speculative trading.

For observers of BNB Chain news, this split suggests an ecosystem that is quietly re-positioning under the surface. Capital is moving, but not all of it is chasing high-frequency trades. Some may be flowing into lending, RWAs, perps, launchpads or prediction markets that do not generate the same visible spot volumes as DEX swaps, yet contribute meaningfully to the chain’s long-term value proposition.

BNB Chain Builders Stay Busy Despite Volatility

One of the strongest themes in this latest BNB Chain news update is that builders have not slowed down, even in the middle of price volatility and sentiment swings. Several major announcements highlight how infrastructure, incentives and new product categories are evolving on the network.

New Listings, Airdrops and Community Incentives

Binance recently launched APRO (AT) as a new HODLer Airdrop project, allocating about 20 million AT (roughly 2% of supply) to BNB Earn users and listing the token with multiple trading pairs. This move not only brings another data-oracle project into the BNB Chain ecosystem, it also rewards long-term BNB supporters and keeps the airdrop engine whirring at a time when many traders are actively hunting for Binance airdrops and speculative early-stage allocations.

Community-oriented initiatives like these play an important role in reinforcing user loyalty. By distributing new tokens to BNB holders and liquidity providers, Binance effectively funnels attention and liquidity back into the chain, giving emerging projects a bigger launchpad and staking its own reputation on their success.

Institutional DeFi Funds and Infrastructure

Another headline item in the current BNB Chain news cycle is the announcement from DWF Labs of a 75 million dollar multi-chain DeFi fund targeting builders of perpetual DEXs, money markets and yield protocols. While the fund is not BNB-exclusive, it explicitly calls out BNB Chain alongside Ethereum, Solana and Base as major focus networks, underscoring the chain’s appeal not just to retail traders but also to institutional capital looking for scalable DeFi infrastructure.

For the ecosystem, this kind of dedicated capital pool matters. It increases the probability that new BNB Chain protocols will have access to liquidity, market-making, strategic support and early-stage funding, which can significantly accelerate product development. At the same time, it signals that sophisticated funds see DeFi on BNB Chain as a long-term opportunity rather than a short-lived speculative fad.

Prediction Markets and Real-World Assets

The infrastructure story does not end with trading and lending. The recent integration of Myriad, a prediction protocol, into Trust Wallet’s Predictions interface is a prime example of how wallet-native prediction markets are starting to blur the line between everyday crypto users and advanced on-chain products. Myriad reportedly surpassed 100 million dollars in volume and 400,000 traders before partnering with Trust Wallet, and now becomes the first prediction market directly embedded inside a major self-custodial wallet for millions of users.

On the real-world asset (RWA) front, Nano Labs has launched the “Next Big BNB” (NBNB) Program, a comprehensive initiative to build tokenization, custody and compliance infrastructure on BNB Chain. Backed by a treasury strategy that could deploy up to 1 billion dollars of BNB exposure, the NBNB program aims to make BNB Chain a leading venue for RWA issuance, collateralization and yield generation.

Together, these developments demonstrate that while prices fluctuate, BNB Chain builders never really left. From airdrops and oracle projects to prediction markets and RWAs, the chain is steadily broadening its scope beyond pure trading and yield farming into more diversified and sustainable use cases.

What This BNB Chain News Means for the Broader Market

Zooming out, the $8.3B rebound on BNB Chain is part of a wider pattern in crypto. Bitcoin dominance has begun to slip as altcoins mount a comeback, and several large-cap chains are seeing improved metrics in TVL, stablecoin flows and user activity.

BNB Chain’s performance sends three important signals to the broader market. First, it shows that liquidity and attention can rotate quickly back to ecosystems that maintain strong fundamentals and active development, even after periods of underperformance. Second, it underscores how essential real usage and builder momentum are for sustaining rebounds; without them, rallies tend to fade as fast as they appear. Third, it highlights that risk-on sentiment often begins on chains where fees are relatively low, tooling is mature and a wide spectrum of projects already exist.

For investors diversified across multiple chains, BNB Chain news has become a useful leading indicator of appetite for mid-cap and small-cap risk. If BNB and its ecosystem continue to strengthen while Bitcoin trades sideways, it may suggest that the next phase of the cycle will be driven more by sector rotation and narrative-specific plays than by blanket moves in BTC.

Key Risks to Watch Before Going Risk-On

Despite the positive tone of the latest BNB Chain news, it is crucial not to ignore the risks. The crypto market remains highly volatile, macro conditions are fluid, and leverage levels across centralized and decentralized venues can change quickly.

The sharp drop in PancakeSwap volume is a reminder that spot trading activity on BNB Chain is not yet fully restored, which could make some tokens vulnerable to sudden liquidity gaps and sharp wicks in both directions. Regulatory uncertainty around exchanges and centralized infrastructure providers continues to loom in the background, and any negative headlines could spill over into BNB price and the broader ecosystem.

On top of that, the recent small-cap rally means that many tokens are now trading at elevated levels relative to their fundamentals. Without careful risk management, latecomers can easily become exit liquidity for early buyers who accumulated during the fear phase.

For traders and longer-term investors alike, the message is clear: treat this risk-on rebound as an opportunity, but not a guarantee. Use tight position sizing, focus on projects with real usage and revenue potential, and avoid overexposure to thinly traded assets that can move 30% in a single candle.

How to Approach the BNB Chain Ecosystem Now

Given everything happening in the latest BNB Chain news, how might someone think about navigating this environment? While nothing here is financial advice, a few principles stand out.

First, anchor your view in BNB itself. As the primary asset of the ecosystem, BNB’s trend, volatility and relative performance against BTC and ETH often set the tone for the rest of the chain. A sustained uptrend with healthy volume and moderate funding usually supports continued strength in ecosystem tokens, whereas sharp drawdowns or overcrowded leveraged longs can signal caution.

Second, lean into fundamentals and real usage. Projects that sit at the crossroads of current narratives, such as DeFi perps, RWAs, infrastructure, oracle networks, wallet-native features and prediction markets, are more likely to retain value during pullbacks. The latest wave of builder activity on BNB Chain is heavily concentrated in exactly these areas, which suggests where long-term attention might gravitate.

Third, respect the power of on-chain data. Track TVL changes, stablecoin inflows, active addresses and protocol revenues on BNB Chain. When those metrics align with favorable price action and constructive news flow, the probability of a durable trend is higher than when price pumps in a vacuum. Conversely, if prices are ripping while TVL and usage stagnate, the move is more likely to be speculative and short-lived.

Ultimately, the BNB Chain ecosystem today looks like a chain in the middle of a constructive reset: capital is returning, builders are shipping, and sentiment has shifted from terror to cautious optimism. How long that lasts will depend on whether the ecosystem can convert this momentum into sticky users, sustainable protocols and continued innovation.

Conclusion

The latest BNB Chain news around an $8.3B rebound and a visible rotation into small caps is more than a headline. It reflects a subtle but important shift in crypto market structure. After weeks of fear and heavy selling, BNB Chain has re-asserted itself as a key venue for risk-on activity, powered by resilient BNB price action, improving on-chain metrics and a steady stream of builder-driven announcements in DeFi, RWAs and prediction markets.

At the same time, the ecosystem is not in full euphoria. DEX volumes are still recovering, sentiment is cautious rather than greedy, and many small-cap rallies look fragile. For thoughtful participants, this blend of early-stage optimism and lingering caution can be ideal: it offers upside potential without the mania and complacency that often mark the end of a cycle.

If the current trajectory continues, BNB Chain could emerge from this phase with a stronger foundation, deeper liquidity, more institutional engagement and a richer stack of applications spanning DeFi, RWAs, infrastructure and consumer-facing experiences. As always in crypto, though, the key is to respect volatility, stay informed and treat every exciting piece of BNB Chain news as one data point in a much bigger picture.

BNB Chain News FAQs

What does the $8.3B rebound on BNB Chain actually measure?

The $8.3B rebound refers to the increase in the total market capitalization of tokens within the BNB Chain sector over roughly a one-week period. After three consecutive weeks of declines, the combined value of BNB Chain ecosystem tokens climbed about 4.1%, adding around 8.3 billion dollars in market cap. This figure captures the broad recovery across large caps, mid caps and small caps on the network, rather than just the move in BNB alone.

How is BNB itself performing compared with the rest of the ecosystem?

BNB price has been relatively strong. It has moved back toward the 900 dollar region with a weekly gain of close to 5%, reinforcing its position as the largest and most influential asset in the ecosystem. While many small caps have shown bigger percentage moves, BNB’s resilience over time and its central role in gas fees, staking and exchange utility make it the anchor for the broader BNB Chain news narrative.

Why are small-cap tokens on BNB Chain rallying so hard?

Small-cap tokens on BNB Chain are rallying because risk appetite is returning after a period of extreme fear. As traders grow more confident that the worst of the sell-off may be behind them, they rotate out of stablecoins and mega-caps into higher-beta plays that can move faster. On BNB Chain, this rotation has favored a mix of DeFi tokens, meme coins and AI-linked projects, with some names seeing weekly gains above 60% or even 70%. These moves often combine genuine catalysts, such as token buybacks or new listings, with speculative momentum and narrative-driven hype.

Are on-chain fundamentals on BNB Chain really improving or is this just speculation?

There is evidence of real on-chain improvement alongside speculative activity. BNB Chain TVL has inched higher by about 1.6% to more than 9 billion dollars, while daily stablecoin transfer volume has surged above 14 billion dollars after a jump of more than 30%. At the same time, some trading metrics, such as PancakeSwap’s DEX volume, have fallen, showing that the recovery is not uniform. Builder activity is strong, with new airdrops, institutional DeFi funds, wallet-native prediction markets and RWA initiatives all launching on or expanding into BNB Chain. Together, these data points suggest that the rebound is supported by a mix of healthier fundamentals and renewed speculation rather than speculation alone.

How should investors and traders react to the latest BNB Chain news?

Investors and traders should view the current BNB Chain news as a sign that the ecosystem is regaining momentum, but they should not ignore risk. It can make sense to keep BNB and high-quality ecosystem projects on the radar, especially those with clear product-market fit in DeFi, RWAs, infrastructure and prediction markets. At the same time, participants should be cautious about chasing illiquid small caps after massive short-term gains, and should always perform their own research, manage position sizes carefully and remember that crypto markets can reverse very quickly. The most sustainable strategy is to combine excitement about the $8.3B rebound with disciplined risk management and a long-term perspective on where BNB Chain is headed.