The cryptocurrency mining landscape has evolved dramatically, and finding the best bitcoin mining hardware 2025 is crucial for anyone serious about profitable mining operations. Whether you’re a beginner looking to start your first mining rig or an experienced miner seeking to upgrade your equipment, choosing the right hardware can make the difference between profit and loss. With Bitcoin’s increasing difficulty levels and energy costs rising globally, selecting efficient, powerful mining equipment has never been more important. In this comprehensive guide, we’ll explore the top-performing ASIC miners, profitability calculations, and everything you need to know to make an informed investment decision in today’s competitive mining environment.

Understanding Bitcoin Mining Hardware in 2025

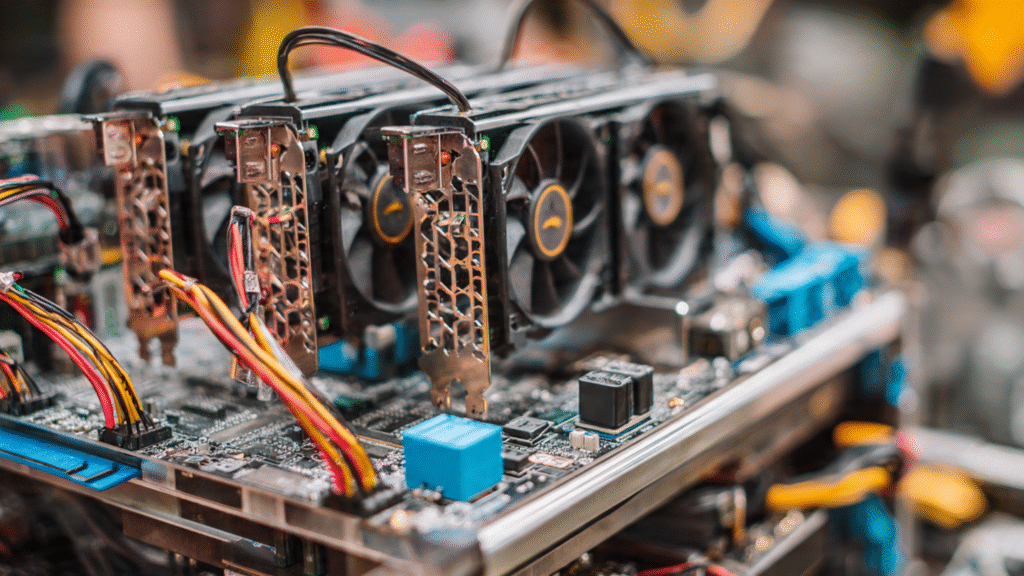

Bitcoin mining has come a long way from the early days when people could mine using standard CPUs and GPUs. Today’s mining landscape is dominated by Application-Specific Integrated Circuits (ASICs), which are specialized devices designed exclusively for cryptocurrency mining. These machines offer unprecedented hash rates and energy efficiency compared to their predecessors.

The mining industry has witnessed significant technological advancement, with manufacturers like Bitmain, MicroBT, and Canaan constantly pushing the boundaries of performance. Modern ASIC miners can achieve hash rates exceeding 150 TH/s (terahashes per second) while maintaining relatively reasonable power consumption levels. The fundamentals of mining hardware is essential before making any investment. The three most critical factors to consider are hash rate (processing power), energy efficiency (joules per terahash), and initial cost. These elements directly impact your return on investment and long-term profitability.

Top Bitcoin Mining Hardware Options for 2025

Bitmain Antminer S21 Series

The Antminer S21 represents Bitmain’s latest flagship offering and consistently ranks among the best bitcoin mining hardware 2025 options available. This powerhouse delivers an impressive hash rate of 200 TH/s while consuming approximately 3,500 watts of power. The energy efficiency ratio of 17.5 J/TH makes it one of the most efficient miners on the market.

The S21 features advanced cooling mechanisms and improved chip architecture, allowing for stable operation even in demanding conditions. Its robust build quality and relatively low noise levels make it suitable for both home operations and large-scale mining farms. Price considerations are important, with the S21 typically retailing between $3,500 and $5,000 depending on market conditions and vendor availability. While the upfront cost is significant, the potential profitability makes it a worthy investment for serious miners.

MicroBT WhatsMiner M60S

MicroBT’s WhatsMiner M60S has emerged as a strong competitor in the mining hardware space. This machine delivers 172 TH/s with a power consumption of 3,344 watts, resulting in an efficiency rating of 19.4 J/TH. While slightly less efficient than the Antminer S21, it offers competitive performance at a potentially lower price point.

The M60S features MicroBT’s proprietary cooling technology and advanced power management systems. Its modular design allows for easier maintenance and part replacement, which can be crucial for minimizing downtime in commercial operations. Reliability has been a hallmark of the WhatsMiner series, with many miners reporting excellent uptime and durability. The M60S typically costs between $2,800 and $4,200, making it an attractive option for those seeking value without compromising too much on performance.

Canaan AvalonMiner 1466

Canaan’s AvalonMiner 1466 represents a solid mid-tier option in the best bitcoin mining hardware 2025 lineup. With a hash rate of 150 TH/s and power consumption of 3,420 watts, it offers an efficiency of 22.8 J/TH. While not the most efficient option available, it compensates with competitive pricing and proven reliability.

The 1466 model features Canaan’s advanced thermal management system and user-friendly interface. Its slightly lower performance makes it ideal for miners operating in regions with lower electricity costs, where raw hash rate matters more than efficiency. Pricing for the AvalonMiner 1466 typically ranges from $2,500 to $3,800, positioning it as a budget-friendly option for those entering the mining space or expanding existing operations without breaking the bank.

Profitability Analysis and ROI Calculations

Understanding profitability is crucial when selecting mining hardware. Several factors influence your potential returns, including Bitcoin’s current price, mining difficulty, electricity costs, and pool fees. Let’s break down how to calculate your expected ROI.

Hash Rate and Network Difficulty

Hash rate represents your mining hardware’s processing power, while network difficulty indicates how hard it is to mine a new block. As more miners join the network, difficulty increases, requiring more computational power to earn the same rewards. The best bitcoin mining hardware 2025 models offer higher hash rates to maintain profitability despite rising difficulty. Current network difficulty hovers around 70 trillion, and historical trends show continuous increases over time. This means that hardware with higher hash rates will maintain profitability longer as the network grows.

Electricity Cost Considerations

Electricity consumption is often the largest ongoing expense in mining operations. The cost per kilowatt-hour (kWh) in your region dramatically impacts profitability. For example, at $0.10 per kWh, running an Antminer S21 costs approximately $25 per day in electricity alone.

Miners in regions with cheap electricity (below $0.08 per kWh) enjoy significant advantages. Some operations relocate to areas with renewable energy sources or negotiate special rates with utility companies. Countries like Kazakhstan, Russia, and certain U.S. states offer competitive electricity rates for industrial users.

Break-Even Timeline

Calculating your break-even point helps determine whether an investment makes financial sense. For a typical setup with an Antminer S21 costing $4,000, electricity at $0.10 per kWh, and current Bitcoin prices, miners can expect to break even in approximately 12-18 months under stable market conditions.

However, this timeline can vary dramatically based on Bitcoin price volatility, difficulty adjustments, and operational expenses. Conservative planning should account for worst-case scenarios, including significant price drops or unexpected hardware failures.

Essential Features to Look for in Mining Hardware

Energy Efficiency Ratings

Energy efficiency, measured in joules per terahash (J/TH), determines how much power your hardware consumes relative to its output. Lower numbers indicate better efficiency. The best bitcoin mining hardware 2025 options typically feature efficiency ratings below 20 J/TH.

Modern ASIC miners utilize advanced semiconductor technology, with many now using 5nm or 3nm chip processes. These smaller architectures allow for more transistors per chip, resulting in higher performance with lower power consumption.

Cooling and Heat Management

Mining hardware generates substantial heat, and proper cooling is essential for longevity and performance. High-end miners feature sophisticated cooling solutions, including multiple fans, heat sinks, and optimized airflow designs.

Ambient temperature significantly affects mining performance. Most ASIC miners operate optimally between 5°C and 35°C. Operations in warmer climates may require additional cooling infrastructure, such as air conditioning or immersion cooling systems, which add to operational costs.

Noise Levels and Location Suitability

ASIC miners can be extremely loud, with noise levels often exceeding 75 decibels—comparable to a vacuum cleaner or busy traffic. This makes them unsuitable for residential settings without proper sound insulation.

If you’re planning home-based mining, consider models with lower noise profiles or invest in soundproofing solutions. Commercial operations typically house miners in dedicated facilities designed to handle noise and heat.

Build Quality and Warranty

Reliability is paramount in mining operations where downtime directly impacts profitability. Reputable manufacturers offer warranties ranging from 6 to 12 months, though extended warranties may be available at additional cost.

Research manufacturer reputation, customer service responsiveness, and availability of replacement parts. Established brands like Bitmain and MicroBT have extensive support networks and readily available components for repairs.

Setting Up Your Bitcoin Mining Operation

Power Requirements and Infrastructure

Before purchasing hardware, ensure your electrical infrastructure can support it. High-performance miners require 220-240V power supplies and dedicated circuits. A typical mining rig needs 15-20 amp circuits, and larger operations may require industrial three-phase power. Consult with a licensed electrician to assess your current capacity and necessary upgrades. Improper electrical setup can lead to fire hazards, equipment damage, and voided warranties.

Mining Pool Selection

Solo mining Bitcoin is no longer practical for individual miners due to astronomical difficulty levels. Joining a mining pool allows you to combine resources with other miners and receive more consistent payouts proportional to your contributed hash rate. Popular mining pools include Foundry USA, AntPool, F2Pool, and ViaBTC. Compare pool fees (typically 1-3%), payout schemes (PPS, PPLNS, or FPPS), and minimum payout thresholds when selecting a pool.

Location and Cooling Strategies

Location significantly impacts mining profitability. Ideal locations offer cheap electricity, cool ambient temperatures, and mining-friendly regulations. Some miners relocate operations seasonally to take advantage of temperature variations. Consider ventilation requirements carefully. Each ASIC miner displaces thousands of cubic feet of air per minute. Inadequate ventilation leads to overheating, reduced performance, and shortened hardware lifespan.

Monitoring and Maintenance

Successful mining operations implement robust monitoring systems to track performance, temperature, and uptime. Software solutions like Awesome Miner, Hive OS, or manufacturer-specific tools provide real-time dashboards and alerts. Regular maintenance includes cleaning dust from fans and heat sinks, checking for firmware updates, and monitoring for unusual behavior. Proactive maintenance prevents costly downtime and extends hardware longevity.

Legal and Regulatory Considerations

Bitcoin mining legality varies by jurisdiction. While many countries welcome mining operations, others have imposed restrictions or outright bans. Research your local regulations regarding cryptocurrency mining, electrical usage, and tax implications.

In the United States, mining income is taxable as ordinary income at fair market value when received. Miners must also consider sales tax on equipment purchases and potential business licensing requirements. Some regions offer incentives for mining operations, particularly those utilizing renewable energy. Texas, for example, has become a mining hub due to competitive electricity rates and favorable regulations.

Comparing New vs. Used Mining Hardware

Benefits of New Equipment

Purchasing new hardware provides warranties, latest technology, and peace of mind regarding condition and provenance. New equipment features the most current chip architectures and efficiency ratings, maximizing long-term profitability potential. Manufacturer support for new equipment includes firmware updates, technical assistance, and replacement parts availability. These benefits justify the premium pricing for many miners.

Used Hardware Considerations

The used market offers potential savings of 30-50% compared to new equipment. However, used miners may have reduced lifespans, voided warranties, and unknown operational history. Hash rates may degrade over time due to chip deterioration.

When buying used equipment, request operational verification, check for physical damage, and understand the remaining warranty status. Reputable sellers provide detailed operational history and may offer limited warranties.

Future Trends in Bitcoin Mining Hardware

The mining hardware industry continues evolving rapidly. Emerging trends include:

Advanced Chip Technology: Manufacturers are developing 3nm and smaller process nodes, promising even greater efficiency. These advances could deliver hash rates exceeding 250 TH/s while maintaining or reducing power consumption.

Immersion Cooling: Liquid cooling technology allows miners to operate at higher performance levels while managing heat more effectively. Though expensive initially, immersion cooling can significantly extend hardware lifespan and improve efficiency.

Renewable Energy Integration: Growing environmental concerns are driving miners toward renewable energy sources. Solar, wind, and hydro-powered mining operations are becoming increasingly common, reducing operational costs and environmental impact.

Conclusion

Selecting the right mining hardware requires careful analysis of your specific circumstances, including electricity costs, available capital, technical expertise, and long-term goals. The best Bitcoin mining hardware options for 2025, such as the Bitmain Antminer S21, MicroBT WhatsMiner M60S, and Canaan AvalonMiner 1466, each offer distinct advantages depending on your priorities.

Remember that successful mining extends beyond hardware selection. Proper setup, maintenance, pool selection, and cost management all contribute to profitability. Stay informed about difficulty adjustments, Bitcoin price fluctuations, and regulatory changes that may impact your operations.

See More : Best Bitcoin Mining Hardware 2025 Top ASIC Miners & Profitability Guide