Are you ready to dive into the world of cryptocurrency mining? This comprehensive bitcoin mining rig setup guide will walk you through everything you need to know to build a profitable mining operation from scratch. Whether you’re a complete beginner or looking to optimize your existing setup, understanding the fundamentals of bitcoin mining hardware, electricity costs, and configuration is crucial for success. In this detailed guide, you’ll discover the exact equipment you need, how to assemble your rig properly, optimal software configurations, and proven strategies to maximize your mining profitability. The bitcoin mining landscape has evolved significantly, and having the right setup can mean the difference between profitable operations and wasted investment. Let’s explore how you can build a mining rig that delivers consistent returns while minimizing common pitfalls that trap inexperienced miners.

Bitcoin Mining Fundamentals Before Setup

Before you start purchasing equipment for your bitcoin mining rig setup guide journey, it’s essential to understand how Bitcoin mining actually works. Bitcoin mining is the process of validating transactions on the Bitcoin blockchain while simultaneously creating new bitcoins. Miners use specialized hardware called ASICs (Application-Specific Integrated Circuits) to solve complex mathematical puzzles, and the first miner to solve the puzzle gets rewarded with newly minted bitcoins plus transaction fees. The mining difficulty adjusts approximately every two weeks to maintain a consistent block time of around 10 minutes.

This means as more miners join the network, the computational difficulty increases, requiring more powerful hardware to remain competitive. Understanding this dynamic is crucial because it directly impacts your profitability calculations and equipment selection. Modern bitcoin mining has become highly competitive, with large-scale mining farms operating thousands of machines in locations with cheap electricity. However, there’s still opportunity for individual miners who approach setup strategically, choose the right equipment, and secure affordable power sources. The key is understanding your break-even point and ensuring your operational costs remain below your mining rewards.

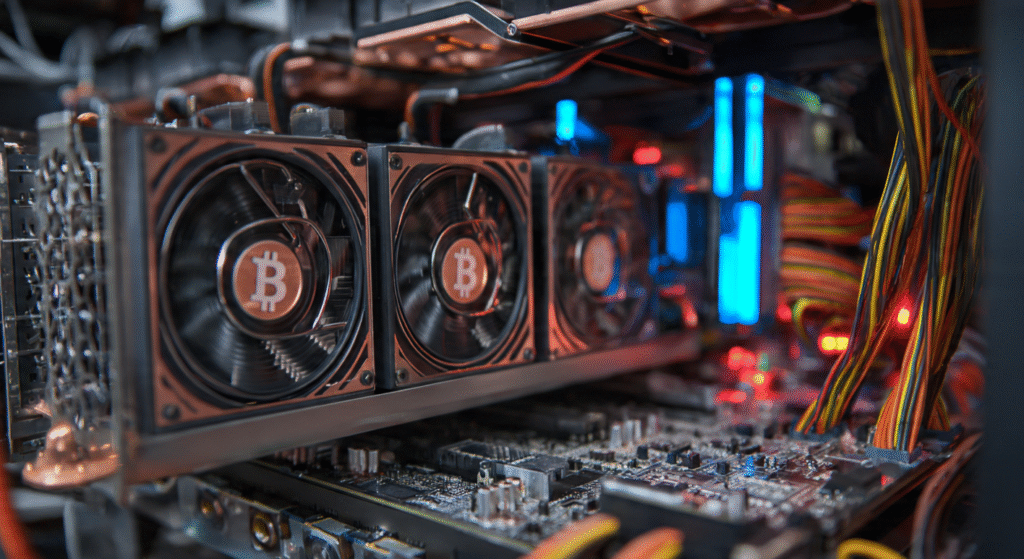

Essential Hardware Components for Your Bitcoin Mining Rig

Building a successful mining operation starts with selecting the right hardware components. The most critical piece is your ASIC miner, which is specifically designed for Bitcoin mining and vastly outperforms GPUs or CPUs. Popular models in 2025 include the Antminer S19 XP, Whatsminer M50S, and AvalonMiner 1366. These machines offer hash rates ranging from 110 TH/s to over 140 TH/s, with power consumption between 3,000 to 5,500 watts. Beyond the ASIC miner itself, you’ll need a reliable power supply unit (PSU) capable of handling the substantial electrical load. Most modern ASIC miners require dedicated PSUs, often sold separately from the main unit. Look for PSUs with 80 Plus Platinum or Titanium certification for maximum efficiency, as this directly impacts your electricity costs and overall profitability.

Additional hardware requirements include stable internet connectivity through ethernet cables (WiFi is generally unreliable for mining operations), proper ventilation equipment like industrial fans or HVAC systems, and adequate electrical infrastructure. Many miners overlook the importance of surge protectors and uninterruptible power supplies (UPS), which protect your expensive equipment from power fluctuations and outages. A quality networking router with reliable uptime is also essential since even brief disconnections can result in lost mining time and reduced earnings. Temperature monitoring equipment is another crucial component often ignored in basic setup guides. ASIC miners generate tremendous heat and require ambient temperatures below 35°C (95°F) for optimal operation. Digital thermometers, thermal cameras, or smart monitoring systems help you maintain ideal conditions and prevent hardware damage from overheating.

Bitcoin Mining Rig Setup Guide: Step-by-Step Installation Process

Now let’s walk through the actual physical setup process for your mining rig. Start by selecting an appropriate location that meets several critical criteria: adequate electrical capacity, excellent ventilation, low ambient temperature, and minimal noise sensitivity. Many successful home miners use garages, basements, or dedicated outbuildings, while others opt for professional mining hosting facilities.

Step 1: Electrical Preparation Before connecting any mining equipment, ensure your electrical system can handle the load. A single ASIC miner drawing 3,500 watts requires approximately 30 amps at 120V or 15 amps at 240V. Consult with a licensed electrician to install dedicated circuits with appropriate amperage ratings. Never overload existing household circuits, as this creates serious fire hazards.

Step 2: Physical Placement and Ventilation Position your ASIC miner on a sturdy, level surface away from walls to allow proper airflow. Most miners feature intake fans on one side and exhaust on the other. Create a direct airflow path by positioning exhaust fans to pull hot air away from the unit while cool air enters freely from the opposite side. In enclosed spaces, consider installing ductwork to channel hot air outside.

Step 3: Network Connection Connect your miner to your router using high-quality ethernet cables (Cat 6 or better recommended). Avoid WiFi connections as they can introduce latency and disconnections that reduce mining efficiency. Assign a static IP address to your miner through your router’s DHCP reservation settings to ensure consistent network access.

Step 4: Power Connection Connect your PSU to the ASIC miner following the manufacturer’s specifications carefully. Most units use multiple PCIe power connectors, and each must be properly seated. Double-check all connections before applying power. Use separate power cables for each connector rather than daisy-chaining multiple connectors on a single cable.

Step 5: Initial Power-On After verifying all connections, apply power to the unit. Most ASIC miners will perform an initial self-test lasting several minutes. During this time, fans will spin up to maximum speed (which is quite loud) before settling into normal operation. Monitor temperature readings during the first few hours to ensure cooling systems are functioning adequately.

Configuring Mining Software and Pool Selection

With your hardware physically set up, the next critical step in this bitcoin mining rig setup guide involves configuring the software and connecting to a mining pool. Individual miners rarely mine solo anymore because the probability of solving a block alone is extremely low. Mining pools combine the hash power of many miners and distribute rewards proportionally based on contributed work. Access your ASIC miner’s web interface by entering its IP address into a web browser.

The default credentials are usually printed on the device or in the documentation (commonly admin/admin or root/root). Once logged in, navigate to the mining configuration section where you’ll enter your pool connection details. Popular mining pools include Foundry USA, AntPool, F2Pool, ViaBTC, and Slush Pool. Each has different fee structures (typically 1-4%), payout methods (PPS, PPLNS, FPPS), and minimum payout thresholds. Research each pool’s reputation, uptime statistics, and fee structure before committing. For redundancy, configure at least two backup pools in case your primary pool experiences downtime.

You’ll need to create an account with your chosen pool and generate a mining wallet address where rewards will be sent. Never use an exchange wallet address for mining payouts; instead, use a personal wallet where you control the private keys. Popular options include hardware wallets like Ledger or Trezor, or software wallets like Electrum for maximum security. In the miner’s configuration interface, enter your pool’s stratum URL, port number, and worker credentials. Most pools allow you to create custom worker names to track multiple miners separately. After saving these settings, your miner should begin submitting shares to the pool. Monitor your pool’s dashboard to verify that shares are being accepted and you’re not experiencing an excessive reject rate (which should be below 1%).

Optimizing Performance and Maximizing Profitability

Simply connecting your miner and letting it run isn’t enough to maximize returns. Performance optimization requires ongoing monitoring and adjustments based on several factors. First, understand the relationship between hash rate, power consumption, and efficiency. Most ASIC miners allow you to adjust power limits and clock speeds through their firmware settings. Running your miner at maximum performance may seem ideal, but it significantly increases power consumption and heat generation while providing diminishing returns in hash rate.

Many experienced miners find that running at 85-95% of maximum capacity provides the best balance between hash rate and efficiency, often reducing electricity costs by 15-20% while only decreasing hash rate by 5-10%. Temperature management directly impacts both performance and hardware longevity. ASIC miners automatically throttle performance when temperatures exceed safe thresholds, reducing your hash rate. Maintaining ambient temperatures between 20-25°C (68-77°F) allows miners to operate at full capacity without thermal throttling.

Invest in adequate cooling infrastructure—the cost is quickly offset by improved performance and extended hardware life. Firmware updates from manufacturers often include performance improvements, bug fixes, and security patches. Check for updates monthly and apply them during low-difficulty periods if possible. Some third-party firmware options like BraiinsOS or VNish offer additional optimization features and improved efficiency, though they void manufacturer warranties and require technical expertise to implement safely.

Calculating Costs and Break-Even Analysis

Understanding your true costs is essential for profitable mining operations. Electricity represents the largest ongoing expense for most miners. Calculate your daily power cost using this formula: (Miner Wattage ÷ 1000) × 24 hours × Your Electricity Rate = Daily Power Cost. For example, a 3,500-watt miner running in an area with $0.12/kWh electricity costs: (3500 ÷ 1000) × 24 × $0.12 = $10.08 per day or approximately $303 per month. Compare this against your mining earnings using online profitability calculators from WhatToMine, ASIC Miner Value, or NiceHash.

These tools factor in current Bitcoin prices, network difficulty, and your hash rate to estimate daily earnings. Remember that Bitcoin price volatility and increasing network difficulty mean profitability fluctuates constantly. Your break-even timeline depends on initial hardware costs plus ongoing expenses versus mining rewards. If you purchased an Antminer S19 XP for $3,500 and it generates $15 per day in revenue with $10 in electricity costs, your net daily profit is $5.

At this rate, you’d reach break-even in 700 days (approximately 23 months), assuming Bitcoin prices and mining difficulty remain constant—which they never do. Consider additional costs like internet service, cooling infrastructure, potential hosting fees if using third-party facilities, and a replacement hardware fund since ASIC miners typically have a 3-5 year operational lifespan. Many successful miners plan for 12-18 month break-even periods and treat anything beyond that as profit.

Common Mistakes to Avoid When Setting Up Your Mining Rig

Even experienced miners sometimes fall victim to common setup mistakes that reduce profitability or damage equipment. One of the most frequent errors is inadequate electrical infrastructure. Overloading circuits not only trips breakers but creates serious fire hazards. Always use properly rated wiring, breakers, and outlets installed by licensed electricians. Another critical mistake is insufficient ventilation planning. ASIC miners are incredibly loud (typically 70-80 decibels) and generate tremendous heat.

Placing miners in living spaces without proper sound dampening and heat extraction quickly becomes unbearable. The heat from even a single miner can significantly increase air conditioning costs if not properly exhausted outdoors. Many newcomers also underestimate the time commitment required for maintaining mining operations. Regular monitoring is essential to ensure optimal performance, detect hardware issues early, and adjust settings based on changing network conditions. Plan to spend at least 30 minutes daily checking temperatures, hash rates, and pool statistics, with more extensive maintenance performed weekly.

Purchasing outdated or inefficient hardware is another expensive mistake. While older generation miners may have lower upfront costs, their poor efficiency ratings mean they consume more electricity per hash, making them unprofitable unless you have access to extremely cheap power (typically below $0.05/kWh). Always calculate long-term operational costs rather than focusing solely on initial purchase price. Finally, inadequate security measures leave miners vulnerable to theft—both physical and digital. Secure your physical mining location properly, use strong unique passwords for all miner interfaces, enable two-factor authentication on pool accounts, and regularly update firmware to patch security vulnerabilities.

Scaling Your Mining Operation for Growth

Once you’ve successfully deployed your first mining rig and gained operational experience, you might consider scaling up your operation. Expansion requires careful planning to avoid diminishing returns and operational headaches. Start by assessing your current infrastructure’s capacity—can your electrical system, cooling infrastructure, and internet connection support additional miners? Many miners find that scaling beyond 3-5 units at home becomes impractical due to electrical limitations, noise levels, and heat management challenges.

At this point, consider professional mining hosting facilities that provide industrial-grade power, cooling, and security for monthly fees (typically $0.05-$0.08 per kWh). While hosting adds costs, it often proves more economical than upgrading home infrastructure for larger operations. When purchasing additional equipment, timing matters significantly. Buying miners during market downturns often yields better deals as less profitable miners exit the space and equipment prices drop. Conversely, purchasing at market peaks means paying premium prices just as mining difficulty increases and profitability declines.

Diversification also becomes important at scale. Some operators allocate a portion of capacity to other cryptocurrencies with lower mining difficulty or run a mix of equipment types to hedge against specific hardware failures. However, Bitcoin’s market dominance and liquidity generally make it the most stable long-term mining target. Consider the tax implications of expanding operations, as substantial mining income may classify you as a business rather than a hobbyist, changing your tax obligations and record-keeping requirements. Consult with a tax professional familiar with cryptocurrency to ensure compliance and optimize your tax strategy.

Advanced Monitoring and Maintenance Best Practices

Professional mining operations succeed through rigorous monitoring and preventive maintenance. Implement comprehensive monitoring systems that track key performance indicators including hash rate, temperature, fan speeds, uptime, rejection rates, and power consumption. Several software solutions like Awesome Miner, Hive OS, and Foreman provide centralized management for multiple miners.

Set up automated alerts that notify you immediately when critical thresholds are exceeded—such as temperatures above 80°C, hash rates dropping below 90% of expected output, or miners going offline. Early detection of issues prevents extended downtime and potential hardware damage. Many experienced miners use smartphone apps or Telegram bots for instant notifications wherever they are. Establish a regular maintenance schedule that includes weekly visual inspections, monthly deep cleaning of fans and heat sinks, quarterly thermal paste replacement on high-wear components, and semi-annual comprehensive audits of electrical connections. Dust accumulation significantly impairs cooling efficiency, so miners operating in dusty environments require more frequent cleaning.

Keep detailed records of all maintenance activities, performance metrics, and any issues encountered. This documentation proves invaluable for identifying patterns, troubleshooting recurring problems, and making informed decisions about hardware replacement timing. Spreadsheets or dedicated mining management software help organize this information effectively. Create redundancy wherever possible within your budget. This includes spare PSUs, backup internet connections, and relationships with multiple mining pools. The cost of downtime—both in lost mining rewards and potential hardware damage—typically exceeds the investment in redundant systems.

Legal and Regulatory Considerations for Bitcoin Mining

Before establishing your mining operation, research local regulations governing cryptocurrency mining. Some jurisdictions have implemented restrictions or outright bans on mining activities due to concerns about electricity consumption or cryptocurrency itself. Countries like China have banned mining entirely, while others like Kazakhstan have imposed restrictions after experiencing grid instability. In the United States, regulations vary significantly by state and even municipality. Some areas offer incentives for blockchain technology development, while others have imposed moratoriums on new mining operations.

Texas, for example, has become a mining hub due to cheap electricity and favorable regulations, while New York has implemented mining restrictions in certain areas. your tax obligations related to mining income. In most jurisdictions, mined cryptocurrency is treated as income at the fair market value when received, creating immediate tax liability. Additionally, selling mined coins triggers capital gains taxes on any appreciation. Proper record-keeping is essential for accurate tax reporting and audit defense.

Residential vs. commercial zoning may impact home mining operations. Large-scale mining may violate residential zoning regulations due to noise, power consumption, or business activity restrictions. Check with your local zoning office before investing heavily in equipment that might be prohibited in your location. If you’re renting your location, review your lease agreement regarding business activities, electricity usage, and modifications to electrical systems. Many landlords prohibit mining operations due to the fire risks, electrical load, and potential property damage from heat and condensation.

Environmental Considerations and Sustainable Mining Practices

Bitcoin mining’s environmental impact has become increasingly scrutinized, with critics pointing to the network’s substantial energy consumption. However, forward-thinking miners are implementing sustainable practices that reduce environmental impact while often improving profitability. The key lies in strategic energy sourcing and waste heat utilization. Many mining operations now utilize renewable energy sources like solar, wind, or hydroelectric power. While initial infrastructure costs are higher, renewable energy provides long-term cost stability and insulation from grid electricity price volatility.

Some miners partner with renewable energy facilities to utilize excess capacity that would otherwise go to waste, providing revenue to these facilities while accessing cheap, clean power. Waste heat recovery represents another sustainability opportunity. The tremendous heat generated by mining operations can be captured and repurposed for space heating, industrial processes, or even greenhouse operations. Several innovative projects have integrated mining operations with agricultural facilities, using waste heat to extend growing seasons or dry crops. Stranded gas flaring presents another sustainable mining opportunity gaining traction.

Oil fields often flare natural gas as a waste product, releasing methane—a potent greenhouse gas—into the atmosphere. Mobile mining operations deployed at these sites convert the gas to electricity for mining, reducing emissions while generating revenue. This approach transforms an environmental problem into an economic opportunity. Carbon offset programs allow miners to compensate for their environmental impact by funding renewable energy projects, reforestation, or other carbon reduction initiatives. While this doesn’t eliminate the operation’s carbon footprint, it demonstrates environmental responsibility and may provide marketing advantages.

Future-Proofing Your Mining Investment

The cryptocurrency mining landscape evolves rapidly, requiring strategic planning to protect your investment long-term. One critical consideration is the next Bitcoin halving event, which occurs approximately every four years and reduces mining rewards by 50%. The most recent halving occurred in April 2024, meaning the next one won’t happen until approximately 2028. However, planning ahead ensures you’re prepared for this significant profitability impact. Hardware obsolescence is inevitable as newer, more efficient miners enter the market. Generally, ASIC miners remain competitive for 2-4 years before their efficiency falls behind newer models enough to impact profitability significantly. Budget for equipment replacement by setting aside a portion of mining profits regularly, ensuring you can upgrade before your hardware becomes unprofitable.

Stay informed about technological developments in mining, including improvements in chip technology, cooling solutions, and firmware optimization. Join mining communities on platforms like Reddit, Discord, or specialized forums where experienced miners share knowledge and discuss industry developments. This information helps you make informed decisions about when to upgrade, which equipment offers the best value, and how to optimize your current setup. Consider the broader cryptocurrency market cycles in your planning. Bitcoin and the broader crypto market tend to follow roughly four-year cycles aligned with Bitcoin’s halving events. Understanding these patterns helps inform decisions about when to expand operations, when to secure profits, and when to weather downturns while less capitalized miners exit the space.

Troubleshooting Common Mining Rig Problems

Even well-configured mining rigs occasionally experience issues requiring troubleshooting. Understanding common problems and their solutions minimizes downtime and maintains profitability. One frequent issue is miners going offline unexpectedly. This usually stems from network connectivity problems, overheating causing automatic shutdowns, or power supply failures.

When a miner goes offline, start by checking physical connections—power cables, ethernet cables, and PSU connections. Ensure the circuit breaker hasn’t tripped due to power surges or overload. Check your miner’s IP address hasn’t changed if you didn’t configure a static IP reservation. Access your router to verify the device appears connected to the network.

Conclusion

This comprehensive bitcoin mining rig setup guide has equipped you with the knowledge needed to establish a profitable mining operation. From selecting the right hardware and configuring optimal software settings to implementing monitoring systems and troubleshooting common issues, you now understand the complete process of setting up a mining setup.

Success in Bitcoin mining requires thorough planning, realistic profitability expectations, and commitment to ongoing optimization and maintenance. While the initial investment may seem substantial, a properly configured mining rig can generate consistent returns for years when operated efficiently in a suitable environment with affordable electricity.

See More : Bitcoin Mining Rig Setup Guide Complete Step-by-Step Tutorial