Not long ago, artificial intelligence (AI) and Bitcoin felt like separate revolutions. AI belonged to labs, data centers, and software companies. Bitcoin lived in crypto exchanges, hardware wallets, and the dreams of decentralization. Today, that line is blurring fast. More often, traders, analysts, and long-term investors notice something new: AI and Bitcoin now shape a shared market trend. Both have become symbols of the digital future. They attract similar types of investors, move on similar narratives, and often react in parallel to macroeconomic news, regulation, and sentiment around technology. As a result, the AI market and the Bitcoin market are no longer isolated stories. They are intertwined, feeding off the same excitement about innovation, automation, and the next big wave of digital value. In this article, we will explore why AI and Bitcoin are converging,

The rise of digital-first investment themes

Over the last decade, markets have increasingly organized around themes, not just sectors. Instead of thinking only in terms of “tech,” “finance,” or “energy,” many investors now chase big ideas like automation, decentralization, and digital transformation. AI and Bitcoin both fit perfectly into these themes. AI promises automation of knowledge work, smarter decision-making, and new productivity gains across every industry. Bitcoin, meanwhile, represents digital scarcity, a non-sovereign store of value, and a decentralized alternative to traditional money. Both tap into the belief that software, data, and cryptography will dominate the economy of the future. As more capital flows into “future tech” narratives, it often doesn’t stop at one asset class.

Shared sentiment: risk-on, innovation-heavy, and forward-looking

Another layer of connection comes from risk appetite. Both AI and Bitcoin thrive in a risk-on environment, when investors are comfortable taking chances on new technologies and disruptive ideas. When interest rates fall, liquidity increases, or optimism about growth returns, the same wave of risk-taking often drives money into AI companies, AI infrastructure providers, and Bitcoin. When fear rises, regulations tighten, or recession worries grow, both sides can suffer sharp pullbacks. This shared sensitivity to sentiment and macroeconomic conditions further aligns their trends. For many traders, AI stocks and Bitcoin are part of the same mental bucket: high-potential, high-volatility bets on the digital future. Bitcoin Now Shape.

Tech infrastructure overlaps: chips, cloud, and compute

Modern AI depends heavily on high-performance computing, GPUs, and cloud infrastructure. Bitcoin, while much simpler computationally, also relies on large-scale computing facilities for mining and network security in proof-of-work systems. This overlap means that both AI and Bitcoin are tied to a similar backbone of data centers, energy consumption, and specialized hardware. When markets get excited about demand for chips, cloud capacity, or energy for digital workloads, it often lifts both AI and crypto-related plays. Investors see this shared dependency and sometimes treat AI and Bitcoin as two faces of the same compute-heavy economy, where digital processes generate value from electricity and algorithms rather than traditional manufacturing. Bitcoin Now Shape.

Digital-native investor base and 24/7 narratives

Both AI and Bitcoin attract a digitally native audience. These are investors who live on social platforms, follow tech news in real time, and participate in online communities that form opinions rapidly. AI updates, product launches, and breakthroughs in machine learning models can boost confidence in tech in general. That enthusiasm can spill over into crypto markets, especially Bitcoin, which is often viewed as the flagship of digital assets. Conversely, when Bitcoin rallies sharply, it can create a halo effect around innovation assets, making AI companies more attractive as part of a broader “future economy” trade. This continuous feedback loop contributes to the synchronized trend between AI and Bitcoin.

AI-powered trading algorithms in Bitcoin markets

Crypto markets, especially Bitcoin, have always been friendly territory for algorithmic trading. Their 24/7 structure, high liquidity, and data-rich environment are ideal for automated strategies. In recent years, AI-driven trading bots and machine learning models have become more common in Bitcoin trading. These AI tools analyze order books, social media sentiment, on-chain data, and macro signals to execute trades within milliseconds. As more traders rely on AI-powered strategies, Bitcoin’s price behavior increasingly reflects the patterns and predictions made by these models. This creates a feedback loop: AI models react to market patterns, then help generate new patterns, which influence the next generation of AI strategies. As adoption grows, it strengthens the idea that AI and Bitcoin share not just a theme, but an active, dynamic system of influence. Bitcoin Now Shape.

Sentiment analysis and market prediction

Another area where AI is crucial is sentiment analysis. Bitcoin markets are deeply influenced by news, social media discussions, influencer comments, and regulatory headlines. AI excels at natural language processing, scanning massive volumes of text to extract sentiment in real time. Traders and institutions now use AI sentiment tools to gauge whether the Bitcoin community is bullish, fearful, or uncertain. These tools score news articles, tweets, and community posts, turning unstructured chatter into actionable signals. As these AI-driven signals get integrated into trading strategies, they tighten the connection between AI development and Bitcoin price movements. The better AI becomes at understanding human behavior, the more directly it can shape Bitcoin’s short-term and even medium-term trends.

Transparent on-chain data for AI-driven insights

Bitcoin’s blockchain is fully public and transparent. Every transaction is recorded and time-stamped. For data scientists and AI researchers, this is a goldmine. They can feed years of on-chain data into machine learning models to study adoption patterns, network health, and liquidity flows. Because the data is structured and continuous, AI can uncover subtle relationships that human analysts might miss, such as emerging network clusters, early warning signs of market stress, or correlations between transaction activity and price volatility. This makes Bitcoin a living laboratory for AI-driven research in financial markets. The more AI tools are trained on Bitcoin data, the more intertwined the two become in both academic and commercial contexts.

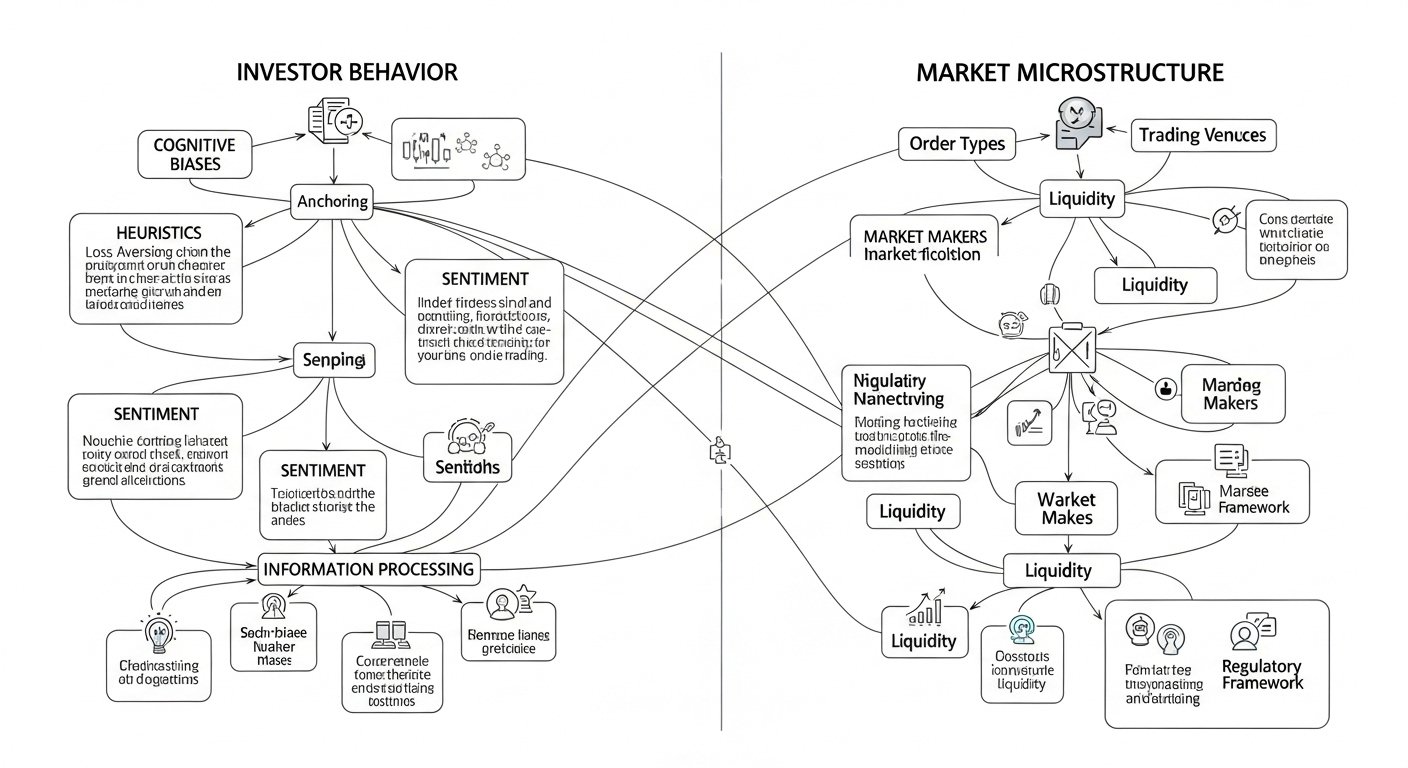

Modeling investor behavior and market microstructure

Bitcoin’s unique mix of retail traders, institutional players, and long-term holders makes it an ideal environment for studying investor behavior. AI models can simulate how different types of participants respond to news, volatility, and macro events. These insights are not limited to crypto. They can be applied to understanding risk behavior in other markets, from tech stocks to emerging assets. In this way, Bitcoin becomes part of a broader AI research ecosystem, strengthening the perception that AI and Bitcoin are evolving in tandem. Bitcoin Now Shape.

Portfolio construction across innovation themes

Large asset managers, hedge funds, and family offices often organize their portfolios around innovation themes. In many of these strategies, AI and Bitcoin appear in the same bucket as “disruptive technologies.” For example, a fund that focuses on next-generation computing may include AI chips, cloud providers, AI software platforms, and sometimes Bitcoin exposure via ETFs or direct holdings. When that fund adjusts its risk level up or down, it might add or reduce exposure across all these assets at once. This type of portfolio construction means that AI and Bitcoin are bought and sold together, regardless of their immediate fundamentals. That naturally aligns their market movements and reinforces the sense that they share an underlying trend. Bitcoin Now Shape.

Regulatory clarity and risk management

Institutions are extremely sensitive to regulation. As regulatory frameworks around both AI and crypto evolve, the market often responds in similar ways. Clearer rules can bring more institutional capital into both spaces, while restrictive regulations can dampen enthusiasm. For example, when policymakers show support for responsible AI development or create legal pathways for Bitcoin ETFs, it signals that the digital future is becoming more legitimate. This can trigger capital inflows into both AI and Bitcoin-related assets. On the other hand, crackdowns on data usage, privacy, or crypto trading can cause simultaneous risk-off reactions in both markets. This shared vulnerability to regulation further synchronizes their trends. Bitcoin Now Shape.

Social media narratives and influencer culture

Platforms like X, YouTube, Reddit, and Telegram host huge communities that follow AI breakthroughs and Bitcoin price movements. Influencers who talk about AI tools, automation, and productivity often also discuss crypto, Bitcoin halving cycles, and digital assets. This crossover creates a cultural bridge. Followers learn to associate AI and Bitcoin with the same big ideas: freedom from old systems, technology-driven wealth, and early-mover advantage. When a social media wave pushes one, it often lifts the other. These viral narratives are reinforced by AI-generated content itself. As content creators use AI tools to produce charts, summaries, and forecasts about Bitcoin, AI becomes part of the storytelling engine behind crypto markets. Bitcoin Now Shape.

The appeal of exponential growth stories

Both AI and Bitcoin are framed as exponential technologies. AI promises rapidly compounding improvements in capability; Bitcoin is often described in terms of exponential adoption curves and network effects. Retail investors are drawn to these exponential stories. They are willing to tolerate volatility in exchange for the possibility of outsized returns. This shared appetite for exponential growth creates a psychological link between AI investments and Bitcoin holdings. The result is that retail portfolios often contain a mix of AI stocks, AI-related tools, and Bitcoin or other cryptocurrencies, enhancing the practical and emotional connection between them.

Amplified volatility and synchronized drawdowns

One obvious risk is amplified volatility. If AI and Bitcoin both respond to similar macro signals and share overlapping investor bases, they may suffer synchronized drawdowns during risk-off periods. For someone heavily invested in both AI and Bitcoin, a negative shock—such as stricter regulation, a major tech selloff, or a global liquidity squeeze—could hit both sides of the portfolio at the same time. Instead of balancing each other, they could compound downside risk. Understanding this correlation is crucial for risk management. Investors may need to avoid assuming that AI and Bitcoin are uncorrelated simply because one is a stock theme and the other is a cryptocurrency.

Overreliance on AI signals in Bitcoin trading

Another risk is the overuse of AI models for Bitcoin trading. If many market participants rely on similar AI-driven signals, the market can become crowded around certain strategies. This can lead to herding behavior, where everyone rushes in or out at similar times, increasing volatility. It can also create model risk: if the AI models are trained on a limited historical period or fail to adapt to a truly new environment, they can mislead traders. Balancing human judgment with AI-driven insights becomes critical. Investors should treat AI as a powerful tool, not an infallible guide. Bitcoin Now Shape.

Smarter Bitcoin tools powered by advanced AI

As AI models improve, we can expect more sophisticated tools for Bitcoin users and investors. These may include AI-enhanced wallets, smarter security systems, personalized risk dashboards, and predictive analytics that help users understand market scenarios in real time. Such tools will make Bitcoin more accessible to mainstream users and institutions. At the same time, they will deepen the dependence of Bitcoin markets on AI infrastructure and innovation, further merging their trajectories.

Bitcoin as part of AI-driven digital economies

As AI automates more economic activity, there will be growing interest in digital-native value systems. Bitcoin, with its global, borderless design, fits naturally into ecosystems where AI agents might transact, reward each other, or store value without human intermediaries. Researchers and builders are already exploring how AI agents could hold and transfer cryptocurrency, including Bitcoin, as part of autonomous systems. While this is still an emerging idea, it highlights how AI and Bitcoin are converging not just in market trends, but potentially in how future digital economies operate. Bitcoin Now Shape.

Conclusion

The idea that AI and Bitcoin now shape a shared market trend is more than a catchy headline. It reflects a genuine shift in how investors, institutions, and communities think about the digital future. AI represents the intelligence layer of this future, automating work, making sense of data, and powering smarter systems. Bitcoin represents the value layer, offering digital scarcity, programmable money, and a hedge against traditional financial structures. Together, they attract similar investors, respond to similar macro and regulatory forces, and increasingly influence each other in real time. Their convergence offers tremendous opportunity—but also concentrated risk—for those who build portfolios, businesses, and research around them. For anyone interested in the evolution of technology, finance, and digital society, watching how AI and Bitcoin move together will be one of the most important stories of the coming decade.

FAQs

Q. Why do AI and Bitcoin often move in the same direction in markets?

AI and Bitcoin frequently move together because they are both seen as high-growth, innovation-driven assets.

Q. Is Bitcoin using AI directly within its core protocol?

The Bitcoin protocol itself does not rely on AI. However, many tools around Bitcoin—such as trading bots, analytical platforms, and risk models—now use AI and machine learning to interpret data, manage portfolios, and execute strategies.

Q. Can AI help me become a better Bitcoin trader or investor?

AI can provide valuable support, such as analyzing market sentiment, spotting unusual activity, or back-testing strategies on historical data. However, it cannot eliminate risk or guarantee profits. The best results usually come from combining AI-driven insights with human judgment, clear risk limits, and a long-term perspective.

Q. Does investing in both AI and Bitcoin increase my portfolio risk?

It can. Because AI and Bitcoin share similar drivers, they may fall at the same time during market stress. This means holding both might increase your exposure to innovation-related volatility. To manage this, many investors diversify into assets with different risk profiles, such as bonds, defensive stocks, or more traditional sectors.

Q. How might the relationship between AI and Bitcoin evolve in the future?

The link between AI and Bitcoin is likely to grow stronger.