The cryptocurrency landscape continues to evolve rapidly, with Bitcoin maintaining its position as the leading digital asset. Investors worldwide are eager to understand the bitcoin price forecast next 5 years as they plan their investment strategies. With Bitcoin’s history of dramatic price swings, volatile market cycles, and growing institutional adoption, predicting its future value requires careful analysis of multiple factors. This comprehensive guide examines expert predictions, technical analysis, market trends, and fundamental drivers that could shape Bitcoin’s trajectory from 2025 to 2030. Whether you’re a seasoned investor or newcomer to cryptocurrency, understanding the long-term price outlook is crucial for making informed financial decisions in this dynamic market.

Bitcoin’s Historical Price Patterns

Bitcoin’s price history reveals distinct patterns that provide valuable insights for forecasting future performance. Since its inception in 2009, Bitcoin has experienced several major bull and bear cycles, typically lasting 3-4 years each. These cycles have been closely correlated with Bitcoin’s halving events, which occur approximately every four years and reduce the mining reward by half.

The first significant price surge occurred in 2013, when Bitcoin reached over $1,000 before crashing to around $200. The second major cycle peaked in late 2017 at nearly $20,000, followed by a prolonged bear market that saw prices fall to approximately $3,200 in 2018. The most recent cycle culminated in 2021, with Bitcoin reaching an all-time high of nearly $69,000 before experiencing another correction.

Understanding these historical patterns is essential when analyzing the bitcoin price forecast next 5 years. Each cycle has been characterized by increasing adoption, technological improvements, and growing institutional interest, suggesting that future cycles may continue this upward trajectory despite inevitable volatility.

The average time between Bitcoin’s halving events and subsequent price peaks has been approximately 12-18 months. With the most recent halving occurring in April 2024, many analysts expect the next major price movement to unfold between late 2025 and early 2026, which aligns with our five-year forecast window.

Bitcoin Price Forecast Next 5 Years: Expert Predictions

Leading cryptocurrency analysts and financial institutions have published various predictions for Bitcoin’s price trajectory through 2030. While these forecasts vary significantly, most experts remain bullish on Bitcoin’s long-term prospects.

Cathie Wood’s ARK Invest has been among the most optimistic, with previous predictions suggesting Bitcoin could reach $1 million by 2030. Their analysis focuses on Bitcoin’s potential as a store of value and its growing adoption by institutional investors and corporations.

JPMorgan Chase analysts have provided more conservative estimates, suggesting Bitcoin could reach $150,000 to $200,000 by 2030 if it continues to gain market share as a digital gold alternative. Their analysis considers Bitcoin’s market capitalization relative to traditional store-of-value assets.

Standard Chartered Bank has published research indicating Bitcoin could reach $250,000 by 2025, driven by increased institutional adoption and the upcoming halving cycle effects. Their forecast extends to potentially $500,000 by 2030 under favorable market conditions.

Technical analysis experts using stock-to-flow models and other quantitative approaches have suggested various price targets ranging from $100,000 to $500,000 by 2030, with most clustering around the $200,000-$300,000 range for the five-year horizon.

It’s important to note that these predictions should be considered alongside the inherent volatility and uncertainty in cryptocurrency markets. The bitcoin price forecast next 5 years depends on numerous variables that could significantly impact actual outcomes.

Key Factors Influencing Bitcoin’s 5-Year Price Outlook

Institutional Adoption and Corporate Treasury Holdings

One of the most significant drivers of Bitcoin’s long-term value proposition is institutional adoption. Companies like Tesla, MicroStrategy, and Square have added Bitcoin to their corporate treasuries, signaling growing acceptance among mainstream businesses.

The trend toward institutional adoption is expected to accelerate over the next five years, driven by several factors including inflation hedging strategies, portfolio diversification needs, and the maturation of cryptocurrency infrastructure. As more Fortune 500 companies consider Bitcoin allocation, demand could increase substantially.

Regulatory Environment and Government Policies

Regulatory clarity will play a crucial role in shaping the bitcoin price forecast next 5 years. Countries worldwide are developing frameworks for cryptocurrency regulation, with some embracing Bitcoin while others impose restrictions.

The United States has made progress toward clearer regulations, with the approval of Bitcoin ETFs and ongoing discussions about comprehensive cryptocurrency legislation. Positive regulatory developments could remove significant barriers to institutional investment, potentially driving prices higher.

Conversely, harsh regulatory crackdowns in major markets could negatively impact Bitcoin’s price trajectory. The balance between regulation and innovation will be critical for Bitcoin’s long-term success.

Technological Developments and Network Upgrades

Bitcoin’s underlying technology continues to evolve, with developments like the Lightning Network improving transaction speed and reducing costs. These improvements could enhance Bitcoin’s utility as both a store of value and medium of exchange.

Layer-2 solutions and other technological advancements may increase Bitcoin’s scalability and functionality, potentially attracting new use cases and users. The successful implementation of these technologies could positively influence long-term price forecasts.

Macroeconomic Conditions and Monetary Policy

Global economic conditions and central bank policies significantly impact Bitcoin’s price performance. During periods of monetary expansion and currency debasement, Bitcoin often benefits as investors seek alternative stores of value.

The ongoing concerns about inflation, currency devaluation, and economic uncertainty could drive increased demand for Bitcoin as a hedge against traditional financial risks. Central bank digital currencies (CBDCs) may also influence Bitcoin adoption patterns over the next five years.

Technical Analysis: Chart Patterns and Price Models

Stock-to-Flow Model Analysis

The stock-to-flow model, popularized by analyst PlanB, has been one of the most widely referenced Bitcoin price prediction tools. This model considers Bitcoin’s scarcity relative to annual production and suggests that Bitcoin could reach $100,000-$288,000 by 2025-2028.

While the model has shown historical correlation with Bitcoin’s price movements, critics argue that it may not account for changing market dynamics and adoption patterns. Nevertheless, it remains a valuable tool for understanding Bitcoin’s potential value based on scarcity metrics.

Rainbow Charts and Logarithmic Growth

Bitcoin’s price has historically followed a logarithmic growth curve, with each cycle producing diminishing returns compared to previous cycles. Rainbow charts, which overlay color-coded bands on Bitcoin’s price chart, suggest that Bitcoin could reach $200,000-$400,000 during the next major bull cycle.

These technical analysis tools indicate that while Bitcoin’s growth rate may decelerate compared to its early years, substantial gains remain possible over the five-year forecast period.

Moving Averages and Long-Term Trends

Long-term moving averages, particularly the 200-week moving average, have provided reliable support levels during Bitcoin’s major corrections. Technical analysts use these indicators to identify potential entry points and long-term trend directions.

The bitcoin price forecast next 5 years based on technical analysis suggests that Bitcoin could experience significant volatility while maintaining an overall upward trajectory, with potential peaks ranging from $150,000 to $500,000 depending on market conditions.

Potential Challenges and Risk Factors

Market Volatility and Corrections

Bitcoin’s historical volatility suggests that significant price corrections are likely during the five-year forecast period. Investors should prepare for potential drawdowns of 50-80% from peak levels, as occurred in previous cycles.

Understanding and planning for volatility is essential when considering long-term Bitcoin investments. Dollar-cost averaging and other strategies can help mitigate the impact of short-term price fluctuations.

Competition from Alternative Cryptocurrencies

The cryptocurrency ecosystem continues to evolve, with new blockchain technologies and digital assets potentially challenging Bitcoin’s dominance. While Bitcoin maintains first-mover advantage and network effects, competition could impact its market share and price growth.

Ethereum’s transition to proof-of-stake, the emergence of new layer-1 blockchains, and the development of central bank digital currencies represent potential competitive challenges for Bitcoin’s long-term value proposition.

Environmental and Energy Concerns

Bitcoin’s energy consumption remains a controversial topic, with environmental concerns potentially influencing regulatory decisions and institutional adoption. The industry’s progress toward renewable energy usage will be important for Bitcoin’s long-term acceptance.

Technological improvements in mining efficiency and the increasing use of renewable energy sources could help address these concerns, supporting Bitcoin’s price trajectory over the forecast period.

Investment Strategies for Bitcoin’s 5-Year Outlook

Dollar-Cost Averaging Approach

Given Bitcoin’s volatility, dollar-cost averaging (DCA) represents a popular strategy for long-term investors. This approach involves making regular purchases regardless of price, potentially reducing the impact of timing decisions on overall returns.

DCA strategies can be particularly effective for investors who believe in Bitcoin’s long-term potential but want to minimize the risk of poorly timed investments. The bitcoin price forecast next 5 years suggests that consistent accumulation could yield substantial returns despite short-term volatility.

Portfolio Allocation Considerations

Financial advisors typically recommend limiting cryptocurrency exposure to 1-5% of total portfolio value, though some advocates suggest higher allocations for younger investors with longer time horizons.

The appropriate Bitcoin allocation depends on individual risk tolerance, investment objectives, and overall financial situation. Conservative investors might prefer lower allocations, while those with higher risk tolerance could consider larger positions.

Risk Management and Exit Strategies

Successful Bitcoin investing requires clear risk management strategies, including profit-taking plans and loss limitation measures. Setting target prices for partial sales during bull markets can help lock in gains while maintaining upside exposure.

Investors should also consider their liquidity needs and avoid investing funds they may need within the five-year forecast period. Bitcoin’s volatility makes it unsuitable as a short-term liquidity source.

Bitcoin Price Predictions by Year: 2025-2030

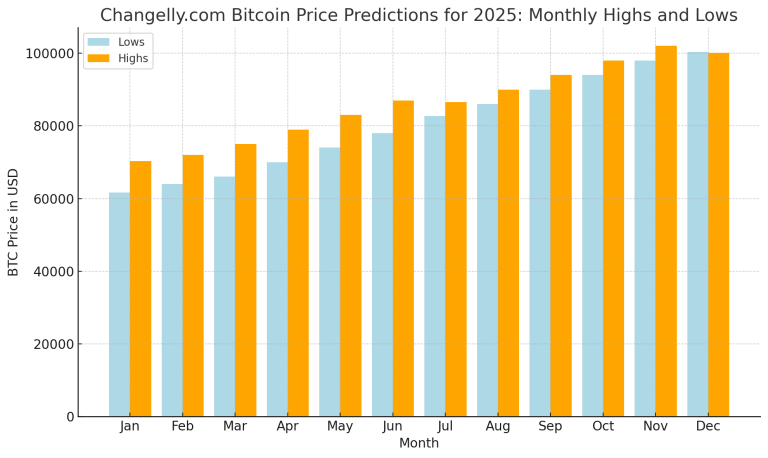

2025 Price Outlook

Many analysts expect 2025 to be a pivotal year for Bitcoin, as the effects of the 2024 halving begin to materialize. Conservative estimates suggest Bitcoin could reach $80,000-$120,000, while more optimistic projections target $150,000-$250,000.

The year 2025 could see increased institutional adoption, potential regulatory clarity in major markets, and continued technological development, all supporting higher price levels.

2026-2027 Market Cycle Peak

Based on historical patterns, 2026-2027 could represent the peak of the current Bitcoin cycle. Price predictions for this period range from $200,000 to $500,000, depending on adoption rates and market conditions.

This timeframe aligns with previous cycle patterns, suggesting that the bitcoin price forecast next 5 years could include a major bull market peak during this period.

2028-2030 Maturation Phase

The later years of the forecast period may see Bitcoin enter a more mature phase, with reduced volatility and more stable price appreciation. Predictions for 2028-2030 suggest Bitcoin could establish new trading ranges between $100,000-$400,000.

This maturation could attract more conservative institutional investors and potentially lead to Bitcoin’s inclusion in traditional investment portfolios and financial products.

Global Economic Impact on Bitcoin Forecasts

Inflation and Currency Debasement

Rising inflation rates and concerns about currency debasement have historically benefited Bitcoin adoption. As central banks continue expansionary monetary policies, Bitcoin’s fixed supply becomes increasingly attractive as an inflation hedge.

The bitcoin price forecast next 5 years must consider ongoing monetary policy trends and their potential impact on Bitcoin demand among both institutional and retail investors.

Geopolitical Tensions and Safe Haven Demand

Bitcoin has increasingly been viewed as a potential safe haven asset during periods of geopolitical uncertainty. As traditional safe havens like gold face storage and transfer challenges, Bitcoin’s digital nature could make it attractive during global tensions.

Countries experiencing currency crises or capital controls may drive increased Bitcoin adoption, supporting higher prices throughout the forecast period.

Emerging Market Adoption

Developing countries with unstable currencies or limited banking infrastructure represent significant growth opportunities for Bitcoin adoption. As mobile internet penetration increases in these markets, Bitcoin usage could expand substantially.

This demographic trend could provide sustained demand growth over the five-year forecast period, supporting higher price levels and increased market capitalization.

Suggested Internal Link Anchor Text: “Bitcoin halving cycles and price history” – linking to a detailed article about Bitcoin’s four-year cycles and historical performance.

Conclusion

The bitcoin price forecast next 5 years presents both tremendous opportunities and significant risks for investors. While expert predictions vary widely, the consensus suggests that Bitcoin could experience substantial growth driven by institutional adoption, technological improvements, and macroeconomic factors favoring alternative stores of value.

However, investors must prepare for continued volatility and potential regulatory challenges that could impact Bitcoin’s trajectory. The cryptocurrency’s journey toward mainstream acceptance will likely include significant ups and downs, making risk management and proper position sizing crucial for long-term success.

As we look toward 2030, Bitcoin’s maturation as a digital asset class seems inevitable, but the exact price path remains uncertain. Whether Bitcoin reaches $100,000, $500,000, or even higher levels will depend on numerous factors that continue to evolve.

Read more: Bitcoin Price Prediction Analysis Today Expert Insights 2025